[1] "BTC-USD"

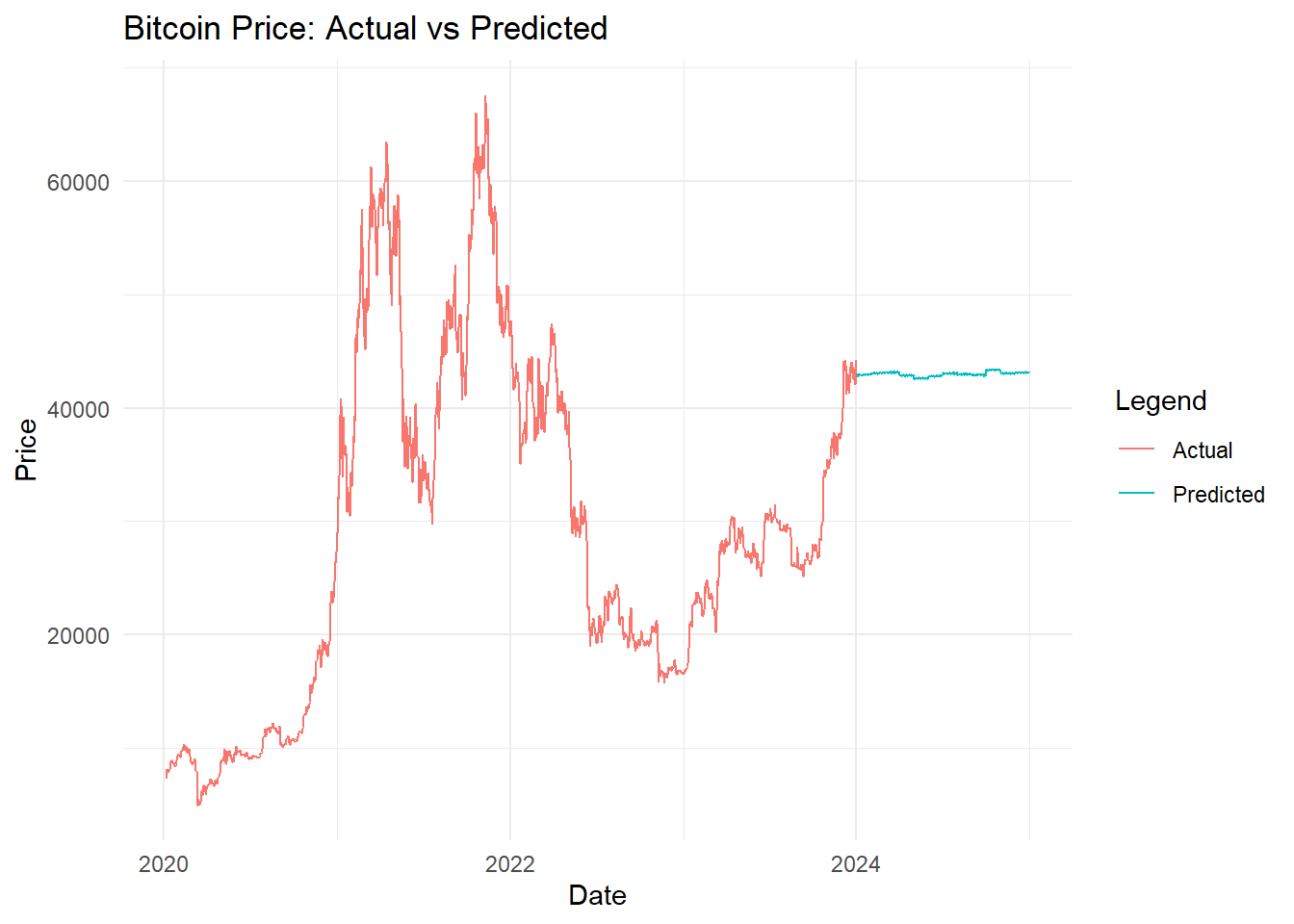

The Bayesian Regression Model is implemented using the brms package. Bayesian Regression provides a probabilistic framework for predictive modeling, incorporating prior distributions to estimate future outcomes. The model is designed to predict Bitcoin prices from 2024-2026 based on historical data from 2020-2024.

[1] "BTC-USD"

The Bayesian Regression model predicts Bitcoin prices from 2024-2026 using the selected features and historical data. While the model provides insights, it also highlights the limitations of Bayesian regression in handling non-linear data, such as Bitcoin prices. The lack of evident cyclicality in the predictions suggests the need for more complex models to capture the inherent volatility in cryptocurrency markets.

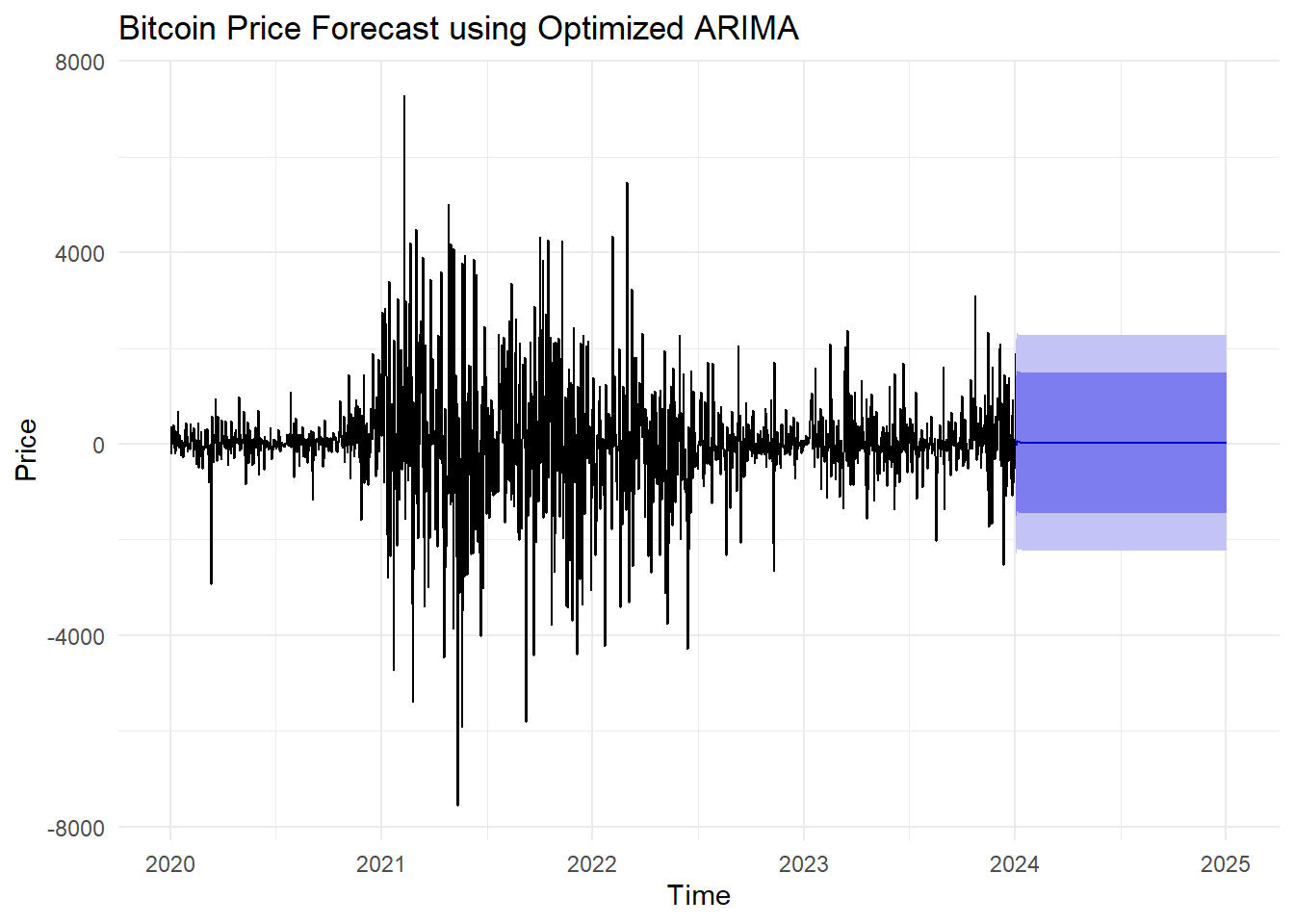

The ARIMA Model(AutoRegressive Integrated Moving Average) model is a widely used time series forecasting technique. In this model, we focused on optimizing key aspects like stationarity and residual autocorrelation to predict Bitcoin prices. The ARIMA model required differencing to address non-stationarity, which was confirmed by an ADF test with a p-value of 0.690, indicating the series was not stationary.

[1] "BTC-USD"

In this ARIMA model, we applied differencing to achieve stationarity and manually identified the model order using PACF and ACF plots. Despite these optimizations, the residuals still displayed significant autocorrelation, as indicated by a p-value of 3.627e-13 from the Box-Ljung test. This suggests that the ARIMA model struggles to fully capture the complexity and volatility of Bitcoin prices.

The Prophet model, developed by Facebook, is designed to handle time series data with strong seasonal patterns and robust predictions. Prophet provides an intuitive approach for forecasting and decomposing time series data, making it suitable for predicting Bitcoin prices and assessing cyclicality.

Our model does suggest that bitcoin could this year demonstrate some levels of cyclicality, however, remember that the training data is based on the past, thus past “cyclical waves” could be dissuading prices. Independently, remember that prices are simply a aggregation of supply/demand, and inevitable those market actors have more impact on those said values.