Introduction

This project investigates Bitcoin price prediction and critically examines the concept of price cyclicality through the application of statistical and machine learning methods. By analyzing historical Bitcoin prices from 2020 to 2024, we aim to forecast trends from 2024 to 2026, assessing whether these trends exhibit cyclicality.

Our approach utilizes three key models:

- ARIMA (AutoRegressive Integrated Moving Average): A time series forecasting model known for its ability to capture temporal patterns in data.

- Prophet (Prophet): A robust forecasting tool developed by Facebook, designed to handle time series data with daily observations and seasonality effects.

- Bayesian Regression: A probabilistic approach that incorporates prior distributions and can provide insights into uncertainty.

By comparing the performance of these models, we evaluate their predictive accuracy and determine whether the predictions reflect cyclical behavior in Bitcoin prices.

Existing Model of Bitcoin Cyclicality

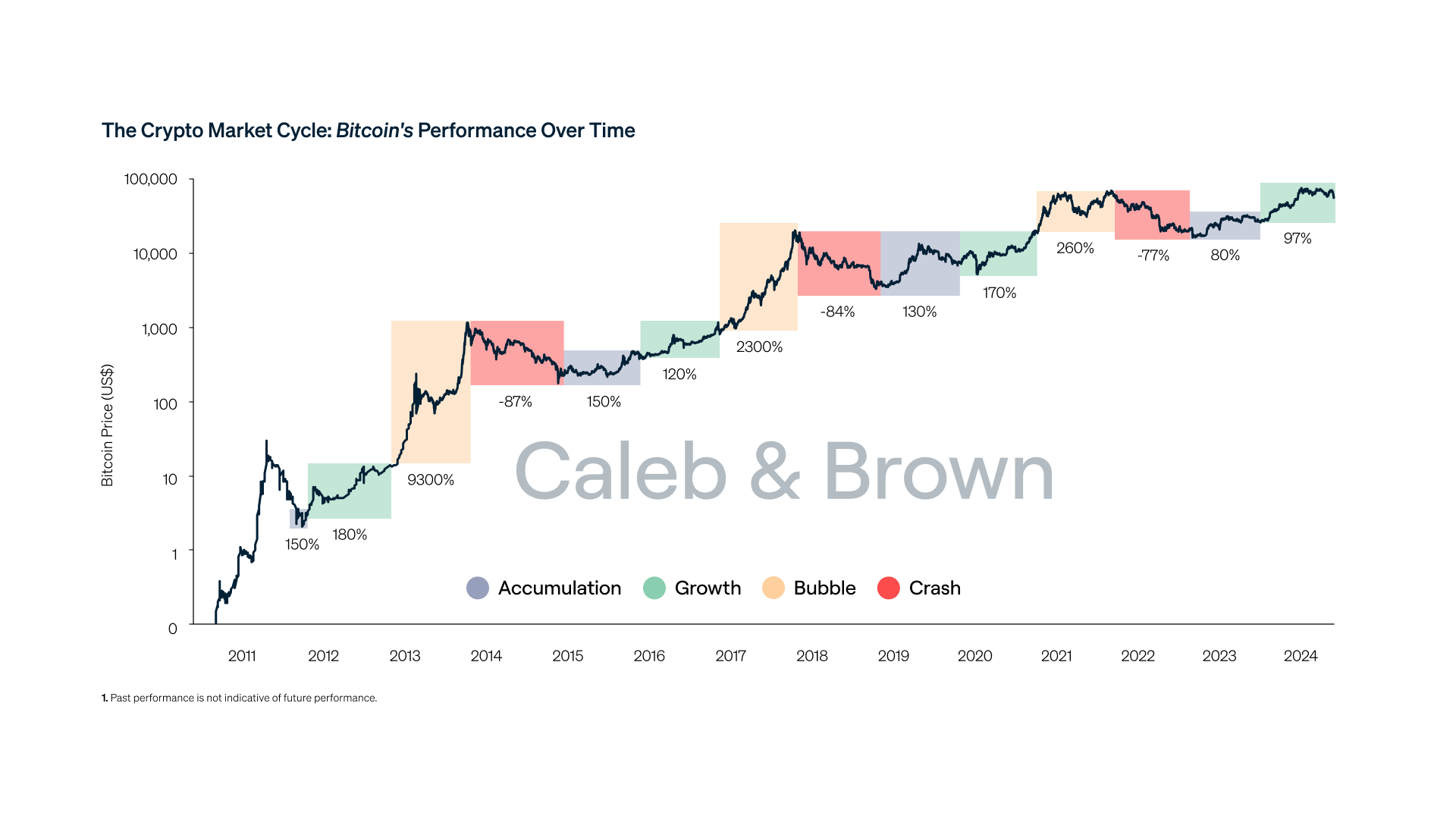

In contrast to our approach, some models propose that Bitcoin prices follow a cyclical pattern. The image below illustrates one such model, which suggests the existence of distinct market cycles within the cryptocurrency space:

This chart depicts the supposed cyclical nature of Bitcoin, highlighting phases such as accumulation, bull markets, and corrections. As we move forward, we will compare our findings against this model to assess whether our predictive analysis aligns with these cycles or refutes their existence.